The one thing that is promised in life is Death and Taxes. I remember when I filed my taxes for the first time in Canada, I had no clue what credits I should be entitled to. I wish I had a guide which I could follow to maximize my tax savings. I would suggest visiting this Canada Revenue Agency (CRA) credits website before you file your taxes. They have included all the credits that an individual can claim under his or her personal income tax return (T1).

- The Two Basic Ideas About Taxes:

- Understanding of your Payslip (T4 Employment Income)

- Self-Employment Income (T2125 form should be filed)

- Tax Strategies You Can Use to Maximize your Tax Refund

- Tuition Fees Tax Credit

- Moving Expenses

- Registered Retirement Savings Plan (RRSP) & First Home Savings Account (FHSA)

- Charitable Donations

- Child Care Expenses

- JAC Consulting, Your Reliable Consulting Firm

- Bottom Line

Before I dive into the nitty-gritty of the tax credits, I want you to know the following:

The Two Basic Ideas About Taxes:

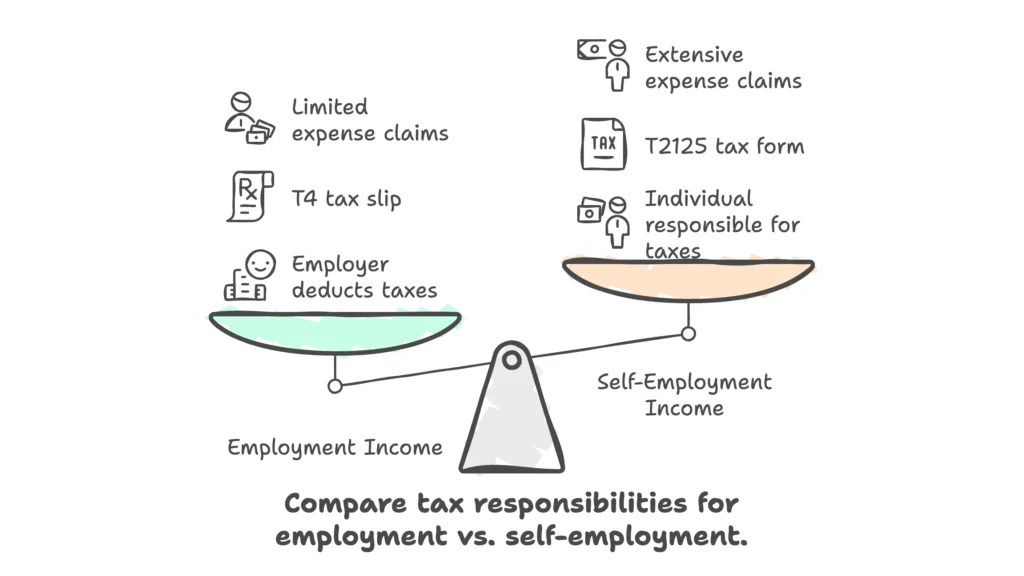

Understanding of your Payslip (T4 Employment Income)

The first step is to have a clear understanding of different components of the payslip. This will be provided by your employer (usually bi-weekly). It will include your employment income. The payslip will show your payroll deductions such as CPP, EI, and income tax. You will see your “Year to Date” amounts on your paystub.

When you work in Canada as an employee for any company, you will be provided with a tax slip called T4 at the end of the year. They usually issue the slip in the month of February of the following year. Let’s assume you worked in 2024, you will receive your T4 in February of the year 2025. You will take that slip to your accountant to file your (2024 in this case) Personal Income Tax Return. Bear in mind, when you have a T4 slip, in most cases, you don’t owe taxes when you submit your tax return because the employer usually deducts enough tax from your bi-weekly paychecks.

Self-Employment Income (T2125 form should be filed)

In this situation, you are on the other side of the spectrum. Basically, you are earning income; however, your employer is not deducting any income taxes, EI, and CPP. The employer is not obligated to remit your taxes to the CRA. There are several ways the employer can communicate this information to you, such as they must have hired you as a “Subcontractor” or you have signed some kind of agreement to work as an “Independent Contractor“.

If you are earning self-employment income, you must be responsible for all your tax owing to the Canada Revenue Agency. I would suggest making tax instalments if you think that you will owe more than $3000 in income taxes. You will be required to submit a T2125 form when you file your personal income tax return.

The beauty about working as self-employed is that it allows you to claim expenses incurred to earn that income. If you are an employee of a firm, you are not allowed to deduct expenses you incurred, such as travelling to the job site.

Having a solid foundation on both of these ideas is extremely crucial. Now you know which side of the spectrum you fall into, which will definitely assist you in choosing your tax credits wisely.

Let’s jump into the tax tips you should be looking out for if you want to maximize your tax savings. I want to remind you that it is solely your responsibility to provide your accountant with all the receipts/slips for the tax year to avoid missing any credits in your tax filing.

Tax Strategies You Can Use to Maximize your Tax Refund

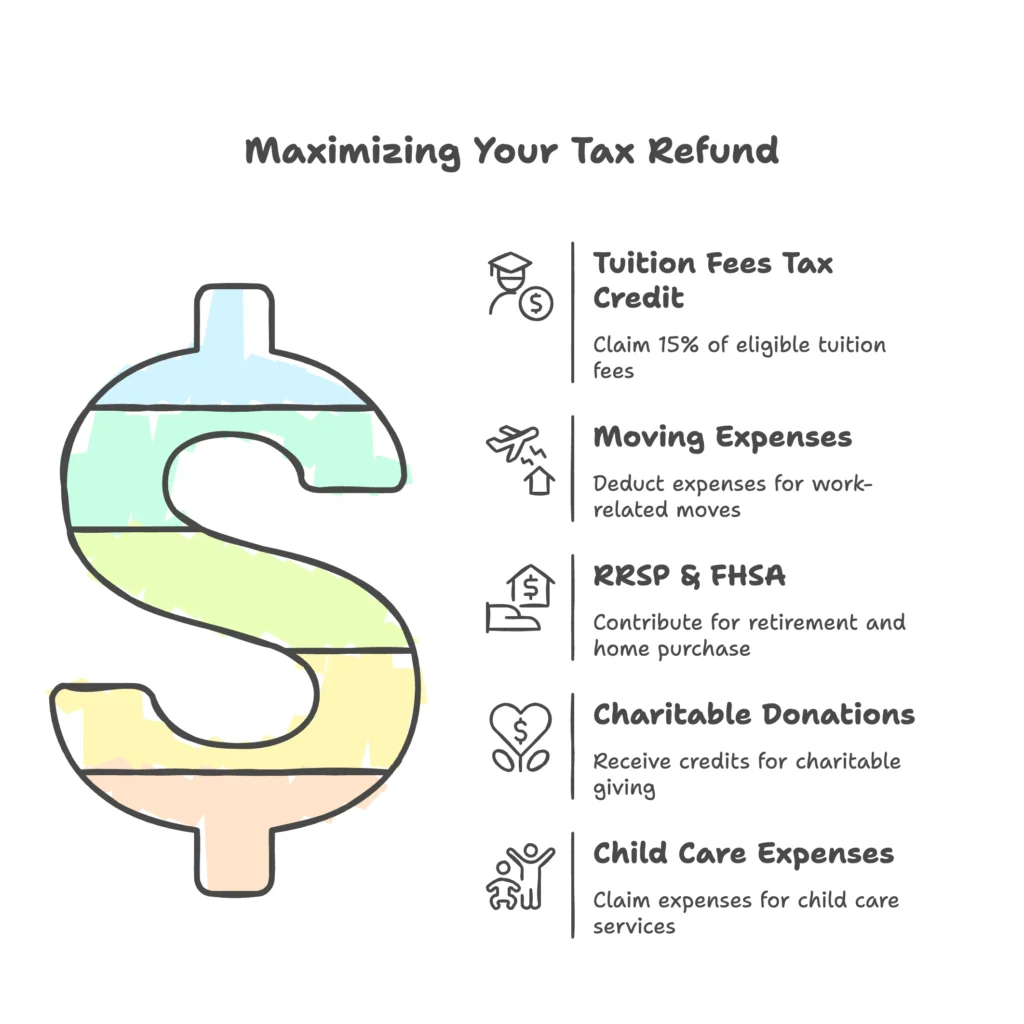

Tuition Fees Tax Credit

You are allowed to claim 15% of tuition fees paid to an educational institution in Canada. To find out if the tuition fees you paid are eligible to claim, use this link. To make a claim, provide the form “T2202a” to your accountant. You should be able to access this form from your school’s official website. It should be under “Tax documents”.

People usually have the misunderstanding that they will get back 15% of tuition fees paid. However, that is not true. 15% of tuition fees is a non-refundable tax credit which goes against your federal tax owing. For instance, if your federal tax owing is $1500 but you have paid/claimed $10,000 in tuition fees, your Net Federal Tax owing will be zero. If you have any questions about this credit, please email me at info@jashthinks.com.

Moving Expenses

If you have recently moved, you might be eligible to claim moving expenses you paid. There are certain criteria to claim moving expenses. When you move to a new home for work-related purposes, let’s say you move from Toronto to Kitchener because your work location changed, you will be eligible to claim those moving expenses.

Similarly, if you move to a new home because you became a full-time student at an educational institution, you will be able to claim all the moving expenses which you have incurred. Another caveat before you jump the gun and claim your expenses: the new home must be at least 40 kilometres closer to your new work location or school.

Registered Retirement Savings Plan (RRSP) & First Home Savings Account (FHSA)

Before we get into this, you should check out some basic information about both of these accounts in the previous article, Master the 3 Tax Bucket Strategy: TFSA, FHSA, RRSP for Smart Investing.

We all are working to make a living but at the same time, we should be saving up for rainy days and retirement. We all know our bodies will not be the same when we reach 65 years of age. It’s better to save up for the future. You can use RRSP for your retirement savings and FHSA to save up for a down payment for your first home in Canada.

Contributing to both accounts will allow you to withdraw money which you have contributed for your first home purchase. The tax savings you will be getting is based on the amount you have contributed. For instance, if you are earning $50,000 per year and contributed $2000 to RRSP and $3000 to FHSA, your Net income will drop to ($50,000-$5000) $45,000 for tax purposes. Ultimately, it will leave you with a larger tax refund.

Charitable Donations

Giving is an act of worship. You should donate to the organizations which you value the most. The donations I have done in the past are to organizations such as Sick Kids and Scott Mission. Basically, you will receive 15% of your donation amount as non-refundable credits, which means it goes against your tax owing, same as tuition fees credits.

Also, if you donate more than $200, you will receive 29% of the amount back in non-refundable credits.

Child Care Expenses

You can claim the amount you paid to someone who looked after your child so that you can go to work, run your business, or go to school. The payments may include:

- caregivers providing child care services

- day nursery schools and daycare centers

- educational institutions, for the part of the fees that relate to child care services

- day camps and day sports schools where the primary goal of the camp is to care for children (an institution offering a sports study program is not a sports school)

- boarding schools, overnight sports schools, or camps where lodging is involved

There are payments which you are not allowed to claim, such as if your employer reimbursed you for the child care expenses, any medical or hospital costs, clothing, and transportation costs.

Child care expenses will directly impact your Net Income. They will decrease your net income, leaving you with larger tax savings.

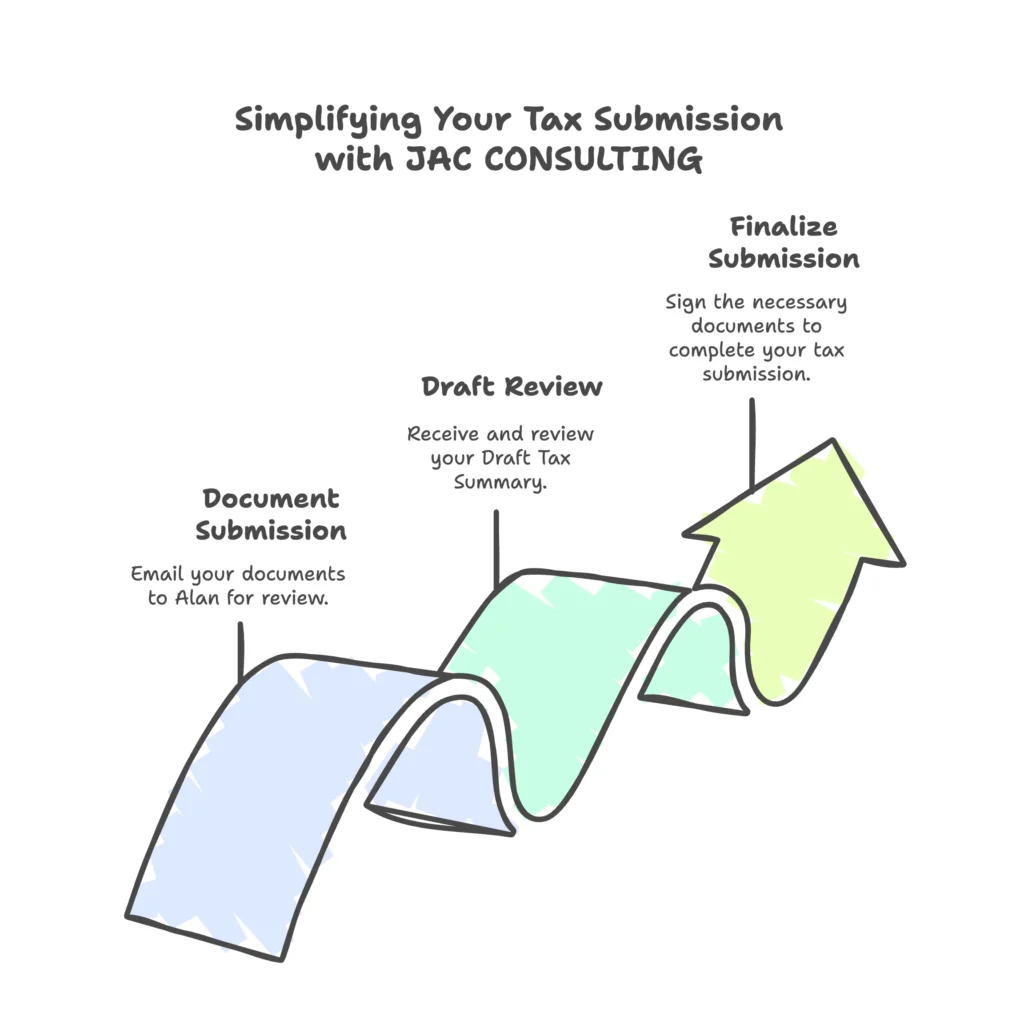

JAC Consulting, Your Reliable Consulting Firm

Taxes can be daunting sometimes. It’s always better to hire a professional who can assist you with your financial goals. I would like to introduce you to my friend, Alan Corvalan, who is a working professional in the accounting industry for three years. He has started his firm, JAC Consulting, to help Canadians with their Personal Income Tax returns and other consulting services.

If you are looking for an accountant to file your personal taxes, I would suggest you give him a try. Please use the code “Jash25” to get a 20% discount on the regular price. Get your taxes done in three easy steps:

- Email Alan all your documents at jac.consulting@pm.me

- You will receive your Draft Tax Summary in less than 12 hours

- Sign the Tax Return and the Engagement letter. BOOM, your taxes will be submitted to the CRA after you sign

Bottom Line

I recommend you check the CRA credits website link provided in the first paragraph before you file your taxes. In that way, you will be able to look for any credits which you or your accountant have missed. You should try to understand the basic ideas of taxes such as earning employment income or self-employment income. Also, don’t forget to use the tax strategies to maximize your tax refund.

Deadline’s ticking. Every unclaimed credit is cash you’re giving away. Let’s fix that—fast.

Leave a Comment