The first step in managing your money is self-awareness. Building money habits requires you to know yourself first. The next steps will automatically fall into shape. Therefore, know yourself first then you will know your money.

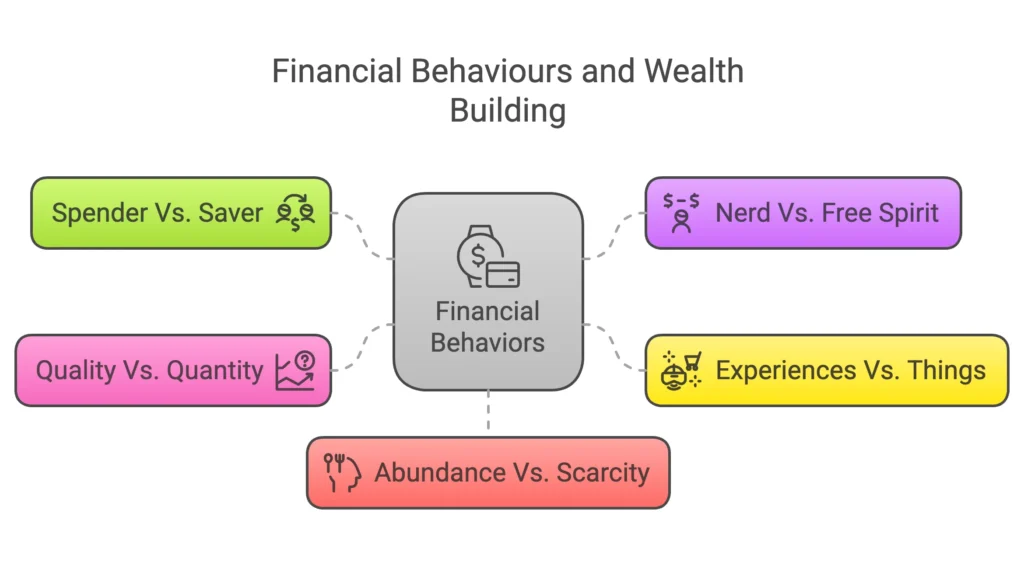

Creating budgeting techniques tailored to your specific situation will be much easier if you can distinguish between different financial behaviours. Our main focus is to identify personal behaviours to improve financial habits. Ultimately, this can assist you in building generational wealth in the long run. First, let’s dive into the financial behaviours part.

Identifying Your Financial Behaviours & Transforming Them into Wealth-Building Habits

Spender Vs. Saver

The first thing you need to find out is if you are a spender or saver. For me, I am a natural saver, and if that’s the case with you, then you must assign some portion of your money to enjoyment. I know sometimes it’s hard to think about enjoyment when you’re saving for something crucial such as a down payment for your first home. But you need to know this: “YOLO” so stop trying to push yourself so hard.

On the other hand, if you are a spender, you should prioritize consistent savings in your budget. You should set up automatic transfers of at least 10% of your paycheck into your savings or TFSA account. In both cases, you need to find the optimal balance – neither extreme is healthy.

Nerd Vs. Free Spirit

I identify myself as a Nerd because nerds love budgets, numbers, and control. I want to know where I am spending each and every dollar. That creates control over my money. If you consider yourself a Nerd, you might find yourself burned out at some point. Little secret: you should practice flexibility to avoid burnout.

However, free spirits are more relaxed about financial planning. In other terms, I would say they are easygoing when it comes to money. They should integrate intentional financial processes to stay on track to create wealth.

Experiences Vs. Things

It took me a while to figure out if I fall under the category of experience people. Experience people prefer events/concerts, trips, and activities, while the things people prefer useful purchases they can use repeatedly. In my opinion, neither is wrong; it’s just different preferences. I believe that I lean more toward experiences rather than purchasing material things. Whichever side you’re on, you must create a budget before going out to concerts or buying that Apple MacBook with M4 Chip.

Quality Vs. Quantity

Basically, this financial behavior represents your preference for few high-quality items vs. many options. Quality people (like me) prefer investing in fewer but better items. However, Quantity people prefer having multiple options at a lower cost.

In my opinion, Quality people should question if premium versions are always necessary. This is what I always ask myself before I make a purchase. If you are a Quantity person, you should practice minimalism and decluttering.

Abundance Vs. Scarcity

In this behavior, you are basically looking at overall financial opportunities. There are two views with which people usually look at financial opportunities. An abundance mentality sees possibilities and opportunities. A scarcity mentality focuses on limitations and potential problems.

I myself have an abundance mentality which helps me channel that positivity into wise financial goals. However, if you have a scarcity mentality, you need to balance caution with trust in God’s provision.

I would suggest that you quiz yourself and figure out where you are on this spectrum. You should distinguish yourself and create room for improvement. These financial behaviours affect our ability to build wealth.

Budgeting Strategies

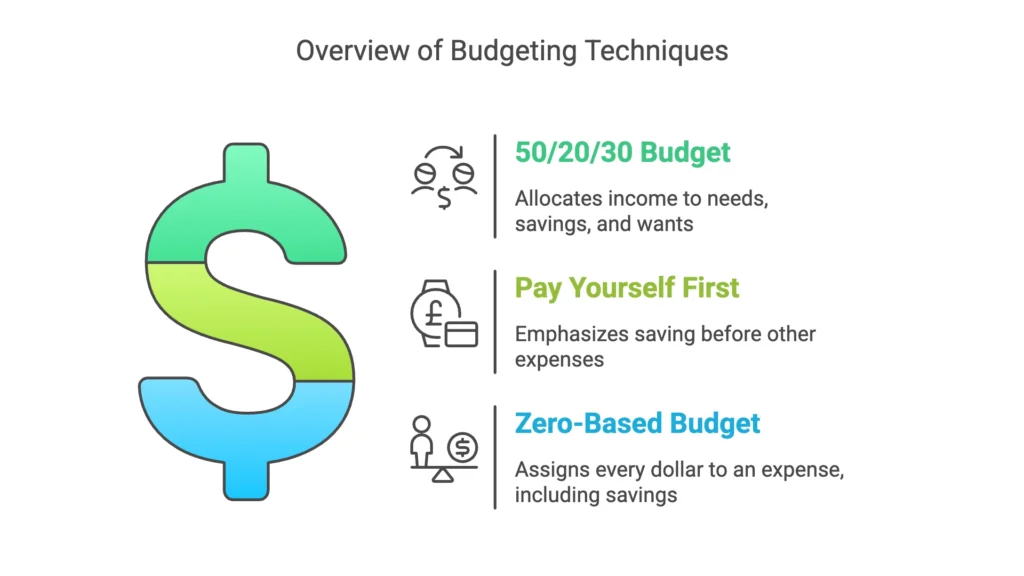

I would like to end this post with some of my budgeting techniques which I have been using to grow my finances. There are a number of different techniques out there which you can follow. I want to provide an overview of those techniques first, then I will reveal which technique I am currently using. Let’s get into the nitty-gritty of this:

The 50/20/30 Budget

In the 50/20/30 budget, you use 50% of your net income toward your needs, 20% going to savings, and 30% going to your wants. To find out more about the differences between needs and wants, please check out this article.

This budget will help you have a specific balance between your needs and wants. It promotes a constant 20% savings rate which is phenomenal.

Pay Yourself First

With this method, you are basically paying yourself first out of your paycheck. You should set aside a fixed amount into your savings or TFSA account at the beginning of the month. You can also use this method in combination with other methods I am explaining.

Zero-Based Budget

In this method, you should assign every single dollar to a specific expense. It will leave you with a zero balance. Please make sure you’re including savings as an expense under this method.

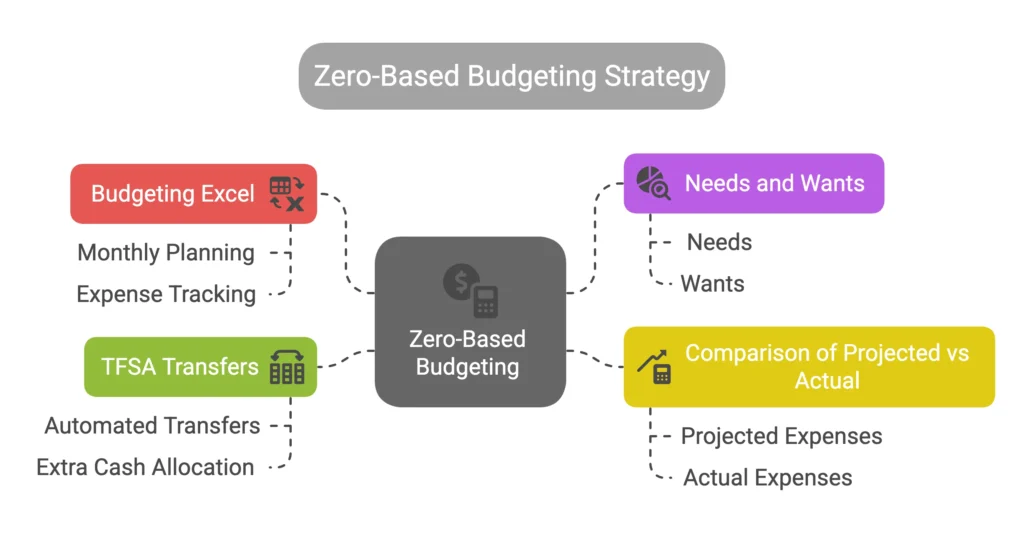

The Budgeting Method I Use

I personally prefer a zero-based budget. I want to know where each and every dollar is going. I use my budgeting Excel spreadsheet every month. I plan a month ahead for my expenses and assign every single dollar of income to specific expenses. I have expenses divided into two categories: needs and wants. I would suggest that you do the same. I have an automated transfer from my checking account into my Wealthsimple TFSA account.

At the end of the month, I create an actual budget to compare what I projected my expenses would be and what my actual expenses were. There might be a chance that you projected more expenses; however, you did not spend that much, which will leave you with extra cash. If that’s the case, transfer your extra cash to your TFSA right away. Also, if you are just starting out investing , please checkout my previous article.

I would love to share my budgeting Excel template. Please leave a comment below if you need one. Here is my link to about me page if you want to know more about what I do for living.

The Bottom Line

I would say that you should quiz yourself first based on financial behaviours. Find out what you are doing right and wrong. Once you have figured it out, you are on your way to building wealth and achieving financial independence. Stay consistent with your savings rate; that’s what matters the most. It’s not about what you are making, it’s about what you are keeping. I want you to read this famous quote by Warren Buffett: “Do not save what is left after spending, but spend what is left after saving.“