In this era of high inflation, investing plays an important role in growing your finances. I started investing back in 2019 when I had no clue what I was doing. I did some research online about different types of investments and bought some individual stocks under my TFSA account. I was using Wealthsimple as a brokerage. First, let’s dive into the three buckets strategy and some basics on TFSA, FHSA, and RRSP.

Disclaimer #1: This post is for general information and illustrative purposes only. It doesn’t consider individual tax situations, so consult a tax professional for advice considering your specific financial situation.

Disclaimer #2: All investments carry risks, and it’s important to understand your risk tolerance before investing.

- What is TFSA, RRSP, and FHSA?

- TFSA (Tax-Free Savings Account)

- RRSP (Registered Retirement Savings Plan)

- FHSA (First Home Savings Account)

- Three Tax Bucket Strategy

- Step 1: Start with TFSA

- Step 2: Move onto FHSA

- Step 3: It’s time to open the RRSP

- Summary of Three Tax Bucket Strategy:

- How I use this Strategy?

- The Bottom Line

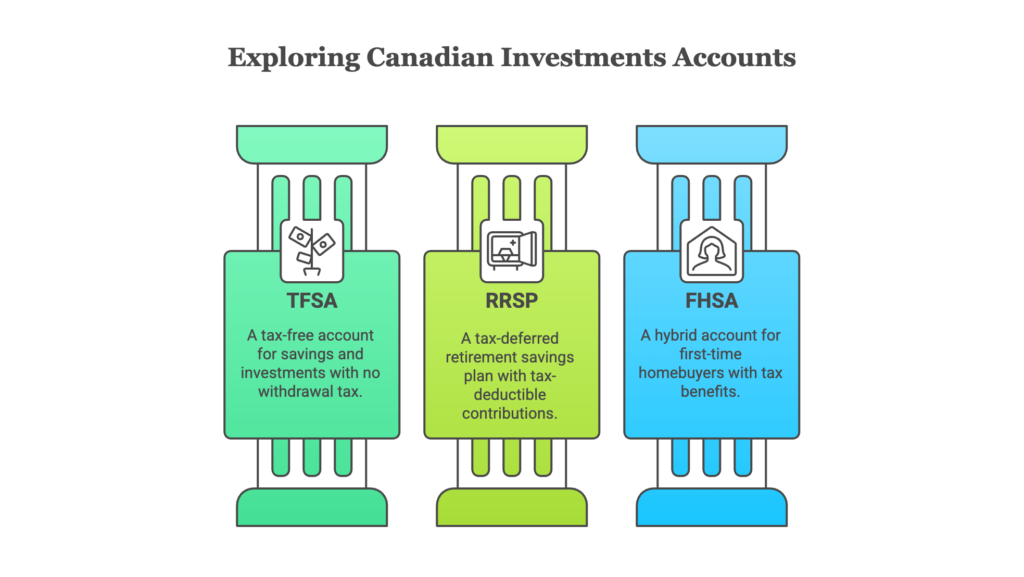

What is TFSA, RRSP, and FHSA?

TFSA (Tax-Free Savings Account)

TFSA is a Tax-Free Savings Account which allows you to invest and earn tax-free growth. Any growth (gains) you have in TFSA will be tax-free, and any withdrawals you make in TFSA will also be exempt from income tax. In this account, there is an annual maximum contribution set by the government, which you must check before making any contributions. You can check the TFSA contribution limit through “My CRA Individual Account” (open the first site or search “My CRA account” on Google). You can sign in to your account, and at the bottom of your overview page, you will see the limits for TFSA and RRSP.

From a tax deduction perspective, contributions to this account will not be tax-deductible in your personal taxes. You cannot claim any of the contributions to reduce your Net Income, unlike the RRSP, which I will explain next.

RRSP (Registered Retirement Savings Plan)

This account serves the purpose of tax-deferred income. Any contributions you make to this account are tax-deductible on your T1-General. Also, any withdrawals you make from this account will be considered “RRSP Income”. That being said, you can use this account when:

- Saving for your retirement

- Saving for your first house down payment

There are only a few ways to make withdrawals from this account without triggering the “RRSP Income,” which are:

- The Home Buyers’ Plan

- Lifelong Learning Plan

You can check the more in-depth details of each plan by visiting this link.

In my opinion, use this account when you are in a higher tax bracket, which will allow you to receive larger tax savings. For example, let’s assume you are earning $90,000 yearly salary and you paid $24,750 in income tax deducted in total (You will find this information on your T4 slip). Assume you have contributed $10,000 to RRSP; when you file your taxes, your net income will be $80,000 instead of $90,000. That being said, you saved taxes owed on the $10,000 which you contributed to RRSP. In this case, you will end up with a tax refund.

FHSA (First Home Savings Account)

This is a kind of new account which became available recently on April 1, 2023. It is a combination of both TFSA and RRSP. The maximum you can contribute is $8,000 each year for 5 years. The government has put the maximum cap (Lifetime Contributions) of $40,000, so your contributions should not exceed that amount. If you haven’t opened and contributed to this account in 2023, you lost the $8,000 contribution for that year. Let’s say you opened the account in 2023 and contributed $2,000 only; then you will be allowed to carry forward your unused contribution of $6,000 to the next tax year. In this case, you will have a $14,000 limit in the tax year 2024.

Withdrawals from this account act similar to RRSP—you can withdraw tax-free if you are a first-time home buyer, or the amount withdrawn will be included in your income. At the same time, when you contribute to this account, that amount will be considered tax-deductible. Why I said it is a combination of RRSP and TFSA is because in this account, your growth/gains on investments are tax-free when you make a qualifying withdrawal (which is for first home purchase). The more details about this account can be found here.

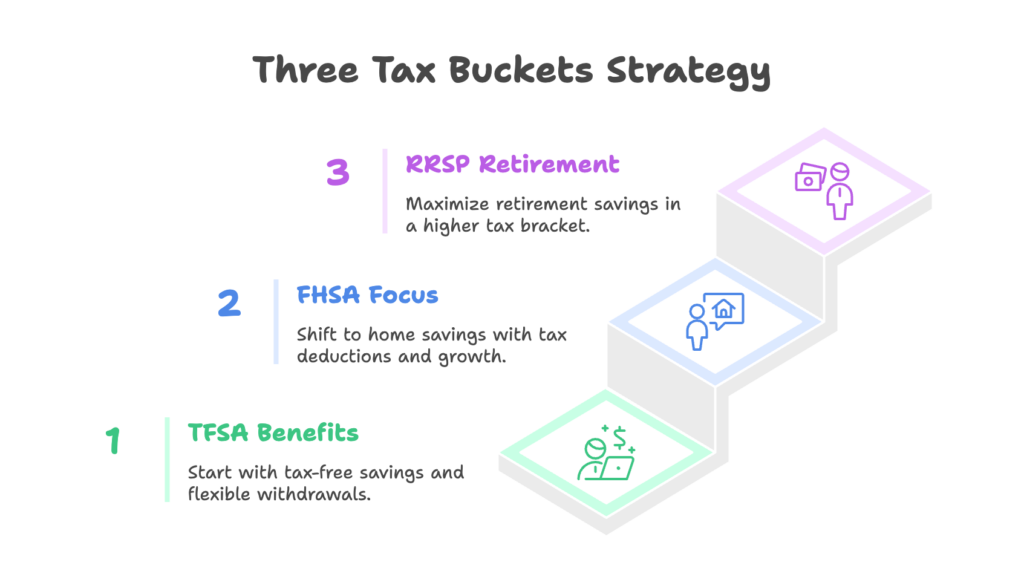

Three Tax Bucket Strategy

Let’s dive into the nitty-gritty of this strategy:

Step 1: Start with TFSA

Basically, I would recommend to start with investing in TFSA, and I will explain why I say that. Number one, the government has set the contribution limit on this account because they don’t want you to take advantage of the account more than the limit, which is a no-brainer to not start with TFSA. Number two, as explained earlier, the gains are totally tax-free, so what are you waiting for? Number three, the withdrawals you make in the current year will get added back to the next year’s contribution limit, which is phenomenal.

Step 2: Move onto FHSA

If you are not a first-time home buyer and have already purchased your first home, please move to Step 3. When you are maxing out your TFSA contribution limit, you should start focusing on FHSA. However, if you are not maxed out in TFSA, then basically it comes down to your priorities. If you are planning to buy your first home in a 2-4 years timespan, stop your TFSA contribution and max out your FHSA, which is $8,000. In this case, not only are you making this contribution tax-deductible but also taking the benefit of tax-free growth when you make a withdrawal for your first home purchase.

Step 3: It’s time to open the RRSP

You should look into this account when you are in a higher tax bracket. As I explained earlier, it will allow you to have more tax savings. This account will provide you with major tax advantages in your 30s, 40s, and 50s—that’s when people usually reach their peak earnings of their lifetime. Savings in this account will assist you big time in your retirement, generating monthly income when you convert this account to RRIF.

On the other hand, if you are maxed out on your TFSA & FHSA, you should start contributing to RRSP. Please make sure you check your RRSP contribution limit; otherwise, you will be penalized.

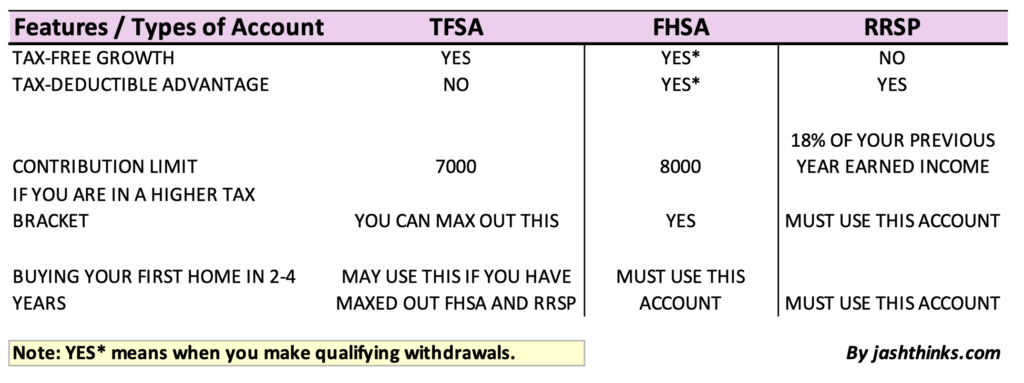

Summary of Three Tax Bucket Strategy:

In my opinion, there is no rule of thumb to start with TFSA, then FHSA, and lastly RRSP. I would recommend looking at the merits of each account first. From there, according to your specific financial situation, you should make a decision which one to start with. Below is the summary of all three accounts which you can use to make a sound decision:

How I use this Strategy?

I started with the TFSA and RRSP at the same time back in 2020; I maxed out TFSA in Aug-2021. I moved onto RRSP; however, my contribution limit for the first year was only $3,500 due to the low Net income. In the later years, I took advantage of RRSP tax savings, then followed by the FHSA, which came out in 2023. So far, I have not maxed out my FHSA yet. Also, if you have any questions about the use of this strategy, please submit your questions to info@jashthinks.com

The Bottom Line

To conclude, I would like to say that you should always look at different options and compare them with your specific situation before making any decision. It would be better if this kind of guide was available to me when I started investing. I made a few mistakes and learned from them. Like I said earlier, use this strategy, and it will help you in all aspects of getting more tax savings, buying your first home, and saving up for your retirement. Lastly, I want to say that all three accounts are hell of a package.

Little secret for you guys: it doesn’t matter if you are living from paycheck to paycheck. What matters is you start investing now and take advantage of compounding growth rather than later. In the next post, I will explain How to Start Investing with Just $500?

If you have any queries or questions about this post, please email me at info@jashthinks.com. Also, if you would like to learn about my CPA journey, please checkout my About me page.