Buying your first car is so exciting. However, there is a laundry list of things you must make sure are in order before you make the second-largest purchase of your life. Obviously, we all know the largest would be a home purchase. Sometimes, car buying process can be real pain and result into poor financial decision.

The first car I bought resulted in a loss of $30,000 CAD. I would have saved a lot if I had known the things that I am going to share with you today. I bought a Cadillac ATS 2018 and financed it for 7 years (Never do that) at a 6% interest rate. I spent a lot on gas, maintenance, and changing summer/winter tires every other year. At the end of this post, I will tell you what I drive now after trading in my good old Cadillac.

Before I dive into the 20/3/8 rule, let’s look at this:

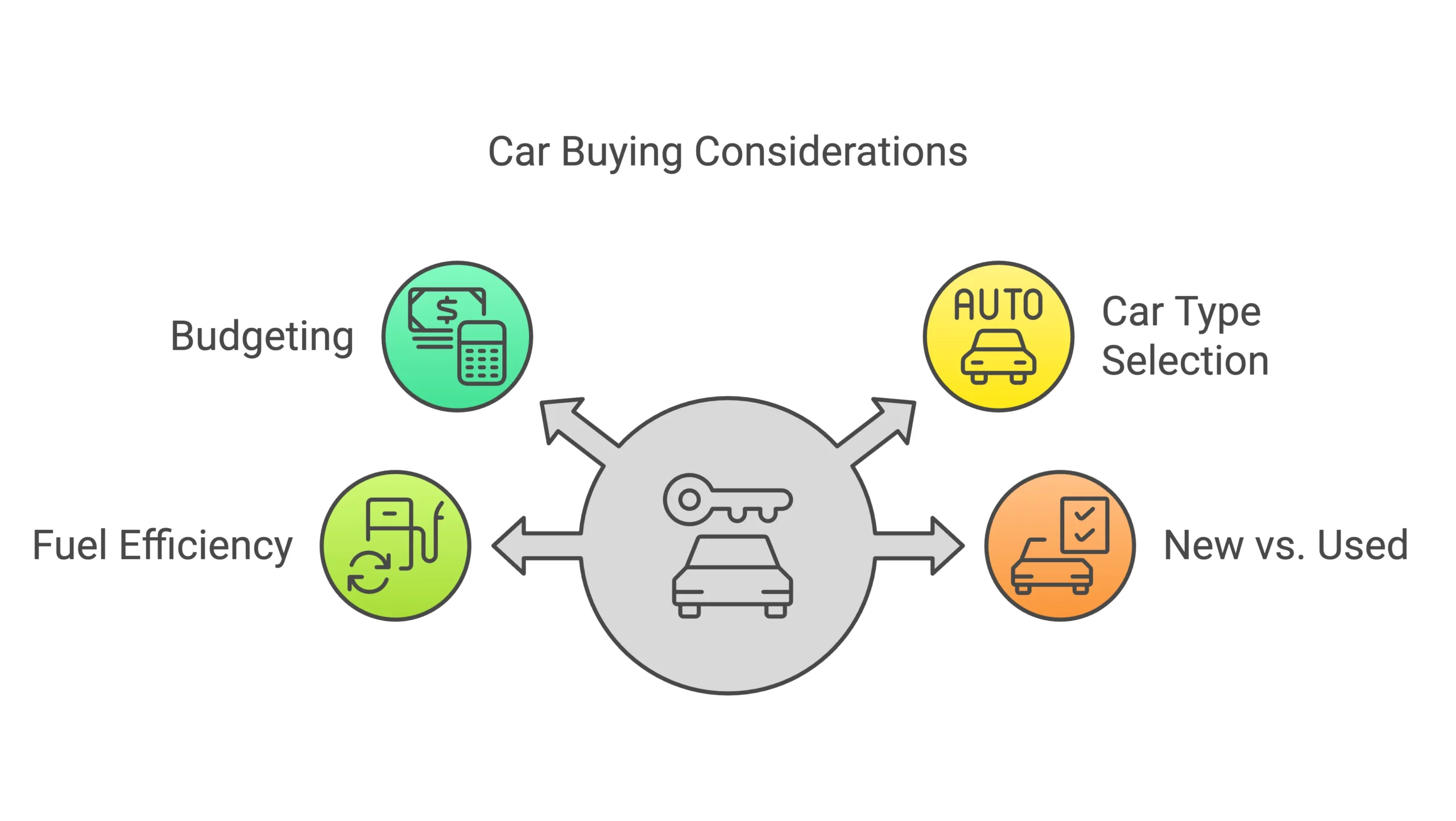

Things to Consider While Buying a Car

Budget: We all know this — without having a price range in mind, you will end up getting a car you’ll regret later (happened to me when I bought the Cadillac). Always know your budget; you can exceed it by maximum $1,000 but not more than that. When you visit a car dealership, they will definitely try to sell you extras on top of the car’s base price. My advice to you in that case is to just stick with your budget.

Type of Car: If this is your first car, you would be fine with a sedan. Different types will work for different lifestyles and needs, such as SUVs, trucks, and luxury vehicles. Choose based on your needs.

Fuel Efficiency: Take a look at this article for Gas, Electric or Hybrid Cars comparison. In my opinion, go for hybrid as I am currently driving a hybrid car (not a plug-in hybrid) and it’s worth it. You will not save a lot on gas, but you know the old saying “half a loaf is better than none.” You will still see a difference as your car will run on EV mode in the city.

New vs. Used Car: There are several differences if you decide to buy a used car rather than a new car. Firstly, insurance costs are usually lower for used cars; however, it also depends on your driver’s license history, car model, year, and location. On top of that, new cars depreciate quickly. If you plan to resell, I would not recommend buying a new car. On the other hand, you may save on the interest rate as new cars come with better financing options.

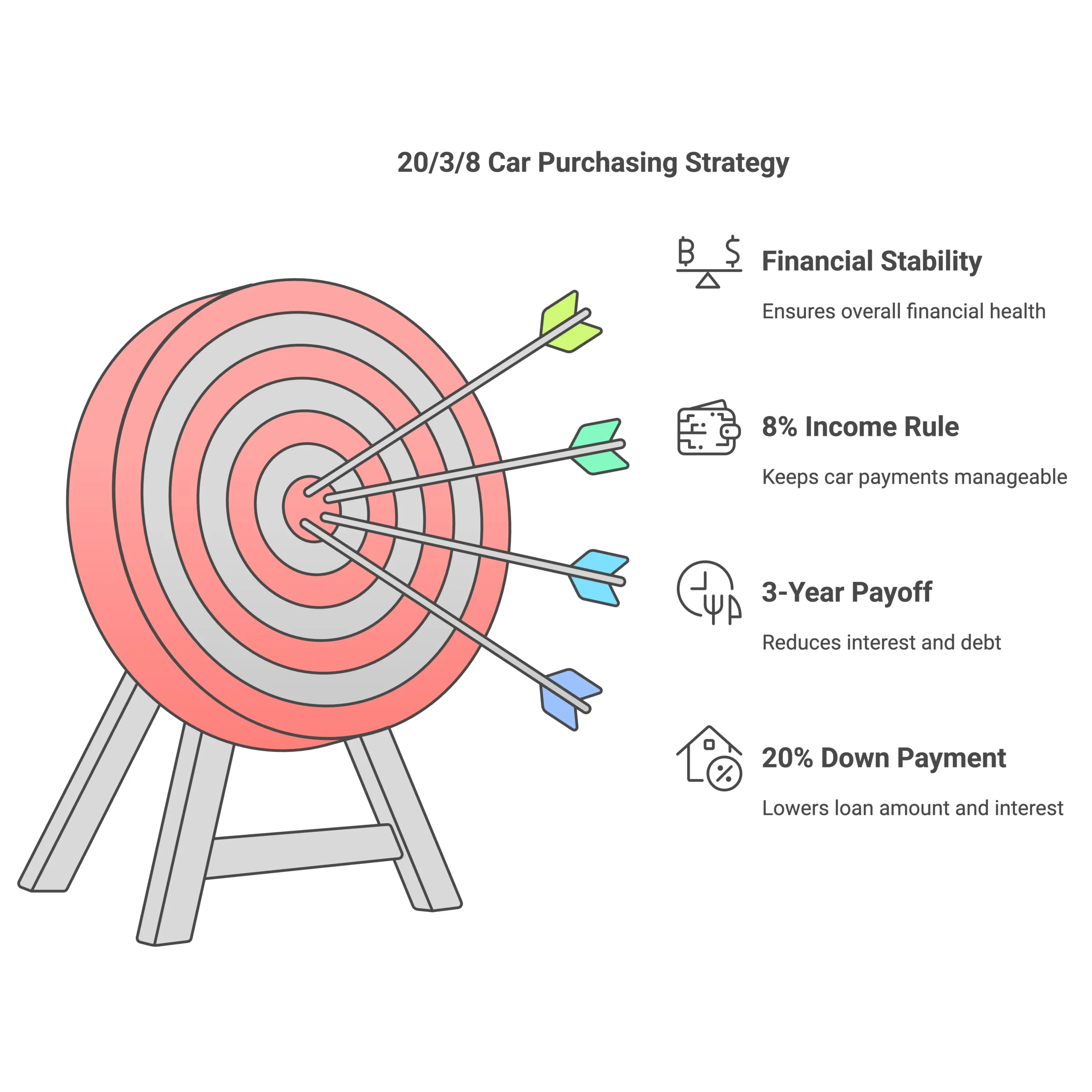

20/3/8 Rule: Lifesaving Rule for Car Purchasing

The 20/3/8 Rule represents that you should be putting at least 20% down payment on any car you buy, paying it off in 3 years or less, and keeping your total car payment(s) to 8% of your gross income or less.

Know someone who is looking to buy a car? Send them this article!

In my opinion, you should use this rule to make your financial life easier. There is no rule of thumb to stick with 20/3/8. You can change or increase the down payment threshold to 30% or 40%. However, it’s extremely important to pay off your car in 3 years or less. Cars lose around 20% of their value in the first year alone.

Looking at the car payments, they should not be more than 8% of your monthly gross income. This will leave you enough room for living expenses, any credit card debt, and investing. This can help you build wealth while keeping things going.

Another factor you must take into consideration is luxury cars. If you are buying a luxury car such as Tesla, BMW, Mercedes, and so on, you should buy it by paying cash or with a maximum loan term of one year.

Lease or Finance: Which is Better?

I want to talk about the numbers side of leasing or financing a car. I am not going to dive into pros and cons for both sides. You can check out this article for that.

My first car, the Cadillac ATS, was financed for 7 years. You can tell me that I did not follow the 20/3/8 rule, and I always regret that. I wish I had known this rule before I made my first car purchase. If you are buying your first car, please do not fall prey to 7- or 8-year terms to bring down your monthly payments. You will end up losing more. I traded my Cadillac for a Toyota Corolla 2023 Hybrid Model. I would say it’s one of the best financial decisions I have ever made in my life. I will share a Google Sheet template with you to calculate if you are better off leasing or financing a car.

Download the Lease/Finance Spreadsheet (Read the instructions first)

You can download the spreadsheet by clicking on this link or use this Google Sheet link (if you don’t use Microsoft Excel) to access it.

How to use the spreadsheet?

- Go to the sheet “Finance or Lease”

- You are allowed to change the values of the cells which are in yellow color.

- Enter your Purchase Value, Term, Interest rate on both Finance and Lease side. Also, update your Lease purchasing value on cell K10.

- I am following the 20/3/8 Rule here, so I am keeping the down payment at 20% and payments to be bi-weekly for 3 years. (Change accordingly, but I would recommend using the 20/3/8 Rule)

Once you are done with these changes, you will be able to see the total cost of borrowing for financing or leasing a car in the green-colored columns. From that point, you will be able to choose which option is better for you. Finally, choose the option with the lower cost of borrowing. I know some of you might be thinking how to come up with the cash at the end of the lease purchasing value (if you decide to keep the car at the end of the lease term).

Save up for Lease Purchase Value (Hack)

When you decide to lease a car instead of finance, your bi-weekly payments are much lower compared to finance bi-weekly payments. Basically, I want you to invest the difference you are saving. By doing that, not only will you save for your lease purchase value but also save up some extra cash. That being said, you will see the calculation performed in the sheet “lease purchasing value hack”. The goal is to invest that difference in an S&P 500 ETF and let it grow for 3 years until you purchase the lease. If you are interested in opening TFSA or any Canadian investment accounts checkout my previous post here.

The Bottom line

Purchasing a car is a significant financial decision that requires careful consideration and planning. The 20/3/8 rule serves as a valuable framework to ensure you make a financially sound choice — putting 20% down, paying off within 3 years, and keeping payments under 8% of your gross income. Whether you choose to lease or finance, it’s crucial to avoid extended loan terms and carefully calculate the total cost of borrowing.

My personal journey from a Cadillac ATS to a Toyota Corolla Hybrid demonstrates how making informed decisions can significantly impact your financial health. By utilizing the provided spreadsheet and following these guidelines, you can avoid costly mistakes and make a car purchase that aligns with your financial goals while meeting your transportation needs.

Remember, the key is not just getting the car you want, but doing so in a way that maintains your financial stability and supports your long-term wealth-building objectives.

If you like the content and want to read about me, please checkout my about me page.

Still got questions related to the spreadsheet or the article? Please comment below or contact me at info@jashthinks.com.